Global Third Party Risk Management Market Trends & Forecast | 2035

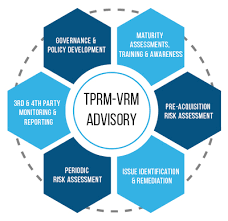

In a market as dynamic and rapidly evolving as Third-Party Risk Management (TPRM), traditional metrics like static market share can often obscure the true momentum of its participants. A more insightful and forward-looking indicator is growth share, which measures a company's portion of the market's overall expansion over a specific period. This dynamic metric is particularly crucial in the TPRM sector, where increasing regulatory scrutiny, supply chain disruptions, and a heightened focus on cybersecurity are creating a significant influx of new customers and budget. An analysis of the Third-Party Risk Management Market Growth Share by Company reveals which vendors are most effectively winning these new opportunities and which are successfully upselling their existing client base with more advanced capabilities. This dynamic view is essential for investors, strategists, and enterprise buyers to identify the market's true innovators and understand the strategies that are proving most successful in the current era of interconnected risk.

A granular analysis of growth share dynamics reveals that companies with strong capabilities in continuous, data-driven monitoring are capturing a disproportionately large share of the market's overall expansion. The security ratings providers, in particular, have demonstrated superior growth rates as their easily digestible, outside-in scores have become a standard component of modern TPRM programs. Another critical driver of high growth is the effectiveness of a vendor's workflow automation and user experience. Platforms that can significantly reduce the manual effort associated with sending, chasing, and analyzing vendor security questionnaires are resonating strongly with overburdened risk and compliance teams. Furthermore, companies that are successfully expanding their risk intelligence beyond cybersecurity to include financial viability, regulatory compliance, and ESG factors are able to address a broader set of customer pain points, thereby capturing a larger share of the overall risk management budget.

The strategic implications of these differentiated growth rates are profound for the market's long-term structure. The companies that consistently capture the largest portion of the market's growth are able to create a powerful virtuous cycle: their success allows them to reinvest more heavily in data acquisition and R&D, attract the best risk and data science talent, and fund strategic acquisitions, thereby reinforcing their leadership position. This dynamic puts immense pressure on legacy players or those with a purely manual, services-based approach, as they risk losing ground to more scalable, technology-driven competitors. The Third-Party Risk Management Market size is projected to grow USD 10.5 Billion by 2035, exhibiting a CAGR of 6.22% during the forecast period 2025 - 2035. For customers, understanding growth share provides invaluable insight into a vendor's momentum, innovation pipeline, and long-term viability, which are critical considerations when selecting a strategic partner for a function as critical as managing supply chain risk.

Top Trending Reports -

- Monuments historiques

- Restaurant Traditionnel

- Education

- Mode

- Formation

- Information

- Restaurant

- culture

- تسويق

- Tourisme

- سياحة

- تنمية

- Découverte

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness